2022 was another banner year for development in St. Louis. The pandemic and inflation didn’t slow things down, resulting in a record dollar amount of building permits issued surpassing 2018. In nominal terms at least. The 2018 amount adjusted by the Consumer Price Index (July 2018 to July 2022) would be $1.425B,a hair more than 2022’s $1.415B. The CPI doesn’t track construction materials and labor exclusively, so is probably not the best to use for this adjustment. Nor can we count on the building permit amounts to reflect price changes. It’s not like someone is obligated to get the amount exactly right or adjust it after the fact. Anyways it’s a big number and an indication of how much is being invested in the city of St. Louis. #Stlbillion2022

Also noteworthy is that the building permit amounts don’t reflect total project costs. Things like property acquisition and architecture services aren’t included. Plumbing, mechanical, and electrical permits aren’t included in this tally either. Another note is that the NGA is not included in any years’ numbers. The Federal government does its own thing.

NextSTL – $1.3 Billion in Building Permits Issued in 2021

NextSTL – Over $1 billion in building permits issued in 2020

Unlike 2020, which had the fewest number of permits issued over the last ten years, 2022 had the third most, indicating the undertaking of more smaller projects. There were 97 (119 in 2021) permits $1M or more totaling $1.156B ($1.032B in 2021). Also there were 94 (107 in 2021) permits issued for new single family homes.

Most new developments and big rehabs received some form of tax incentive- property tax abatement, TIF, sales tax exemption on construction materials, etc or were tax-exempt. There has been more drama this year surrounding development. Ald. Pihl has garnered headlines over the TIF for the Armory and over tax abatement for the Albion West End. Controversial developer Lux Living continues to push for new projects, one of which, the Engineers’ Club, made it past the Preservation Board. Others haven’t shown much physical signs of progress, like 1801 Washington, Cortex MX, SOGRO, and Marshall at Forest Park Ave and Vandeventer. And some plans died like 2000 N Broadway which is now for sale.

StlToday – Bucking tradition, St. Louis aldermen OK tax incentives for Armory entertainment venue

As per usual, neighborhoods in the central corridor saw the most issued by dollar amount.

Will 2023 be another billion dollar year? There are currently over $500M in unissued permits submitted in 2021 and 2022, so 2023 will be off to a good start. Included are the aforementioned Engineers’ Club, Cortex MX, SOGRO, and Marshall as well as The Bridge at Delmar and Euclid, secure office buildings related to the NGA at Cass and Jefferson, and the new build on the 4500 block of Manchester by Grove Properties. I think it’s going to be tough to top a billion in 2023. Interest rates rose last year to combat inflation, stifling financing for development. I don’t think there are any more big BJC projects in the pipeline. The biggest project in the pipeline is Albion, which isn’t nearly as big as the new BJC building replacing Queeny Tower, and it’s doubtful the Railroad Exchange, 909 Chestnut, or Gateway South get rolling with permits this year.

I’m often asked how we compare to other cities. Tough given different population sizes and land areas, not to mention different economic conditions and trajectories. And of course other cities posting their numbers in convenient form or at all. #Transparency Kansas City posts permit data here. Note KC has 314 square miles of land area versus St. Louis’s 62 and a population of 508k (21% of the metro region) v St. Louis’s 293k (10.4% of the metro), while the STL metro area has about a 16% larger population. KC has a lot of green fields that could be developed, while St. Louis does not. So as we see with calculating murder rates to made lazy comparisons between cities, here there is nuance to consider. For 2010-2021 KC issued $14.077B while STL issued $8.775B. A good show considering the relative sizes. From 2012-2021 Clayton had just under $1.4B. If you look at the Kansas City School District (66 sq. mi. and 207k population) as a better analog to St. Louis, 2010-2021 was $6.366B.

How did St. Louis County do? ¯\_(ツ)_/¯ #Fragmentation #Transparency Clayton’s data for FY21 (only thru September 30th)- 417 permits with a total value of $130M. 2020 (~$279M), 2019 (~$333M), and 2018 (~$207M).

A shoutout to the busy bees at the St. Louis Building Commission for posting the permit database and its handy data webpage. Also a big shoutout to all those investing in St. Louis!

Here are the top ten plus two for 2022.

12. Ronald McDonald House – $24.1M – Tax-exempt

NextSTL – 2018 – Ronald McDonald House Coming to FPSE

11. 1014 Spruce – $25M – Tax abatement 10 years @ 40% The abatement was originally larger, but Mayor Jones vetoed the bill.

StlToday – Jones vetoes two central-corridor development bills, saying tax incentives are too big

10. The Edwin w/ Target – $30.8M + $12.3M – CID (1% sales tax), sales tax exemption on construction materials, still can’t verify if it got a property tax abatement from the Midtown Redevelopment Corp.

NextSTL – Target, Incentive Package For Next Steelcote Phase Come into Focus

NextSTL – Steelcote Shoppers to Subsidize Storage Spaces for Sedans and SUVs

NextSTL – Steelcote Next Phase Planned

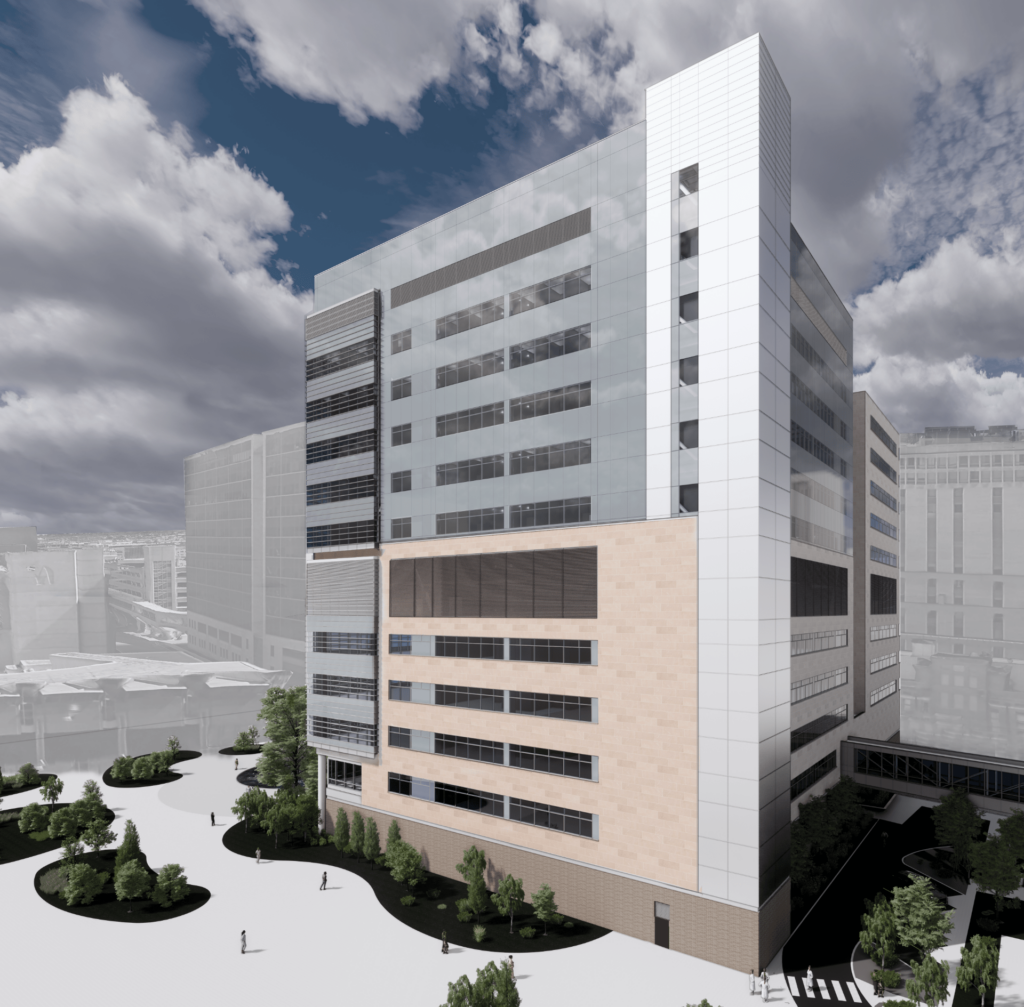

9. BJC Institute of Health at Washington University vertical expansion – $40M – Tax-exempt

8. Foundry Phase II – $43.1M + $11.3M – $19.1M TIF

NextSTL – Permits Issued for City Foundry Phase 2

StlToday – New alderman, St. Louis Mayor Jones push for City Foundry contribution to north city redevelopment

StlToday – City Foundry TIF advances after developer pledges $1.8 million to affordable housing

NextSTL – City Foundry Coverage

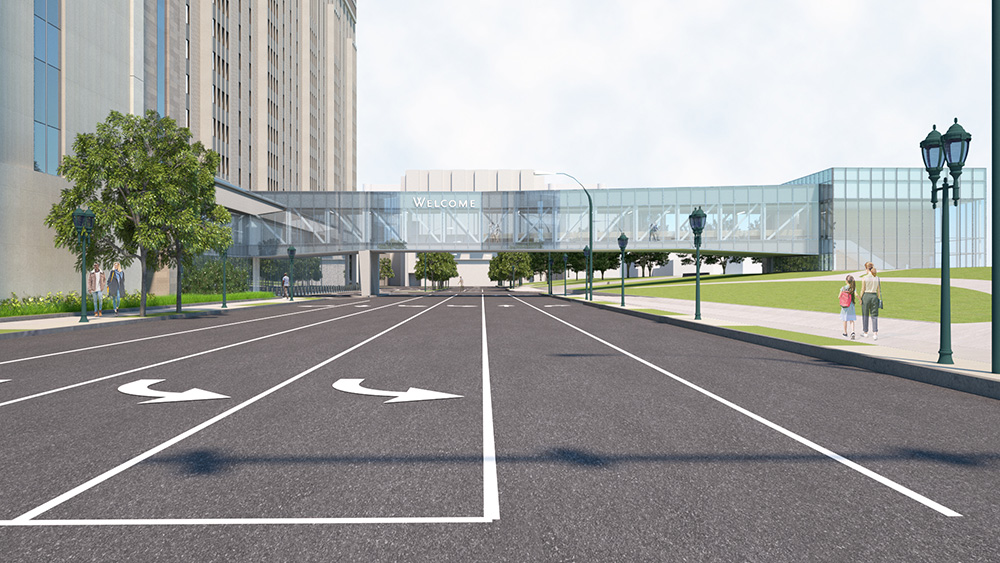

7. Barnes Hospital Plaza Bridge and Entry – $46M – Tax-exempt

6. Jefferson Arms Rehab – $49.3M – $17.3M TIF, historic tax credits

5. The Rail 4591 McRee – $51.5M – Tax abatement for 10 years @ 90%, sales tax exemption on construction materials

NextSTL – Green Street Plans Apartments Next to Bar K at 4591 McRee

4. Bulter Brothers Rehab – $66.1M It will be called the Victor. Tax abatement 95% tax abatement for 5 years, plus 75% for 5 more, then 50% for 5 more years, historic tax credits.

NextSTL – Butler Brothers To Become 384 Apartments

3. Sireman Ambulatory Cancer Center – $75M – Tax -exempt

2. Convention Center Expansion- $85M – Delayed and over budget due to St. Louis County shooting itself in the foot. Tax-exempt

StlToday – How much did it cost St. Louis County to delay convention center bonds? An extra $88 million

- BJC Tower replacing Queeny Tower – $305M – Tax-exempt.