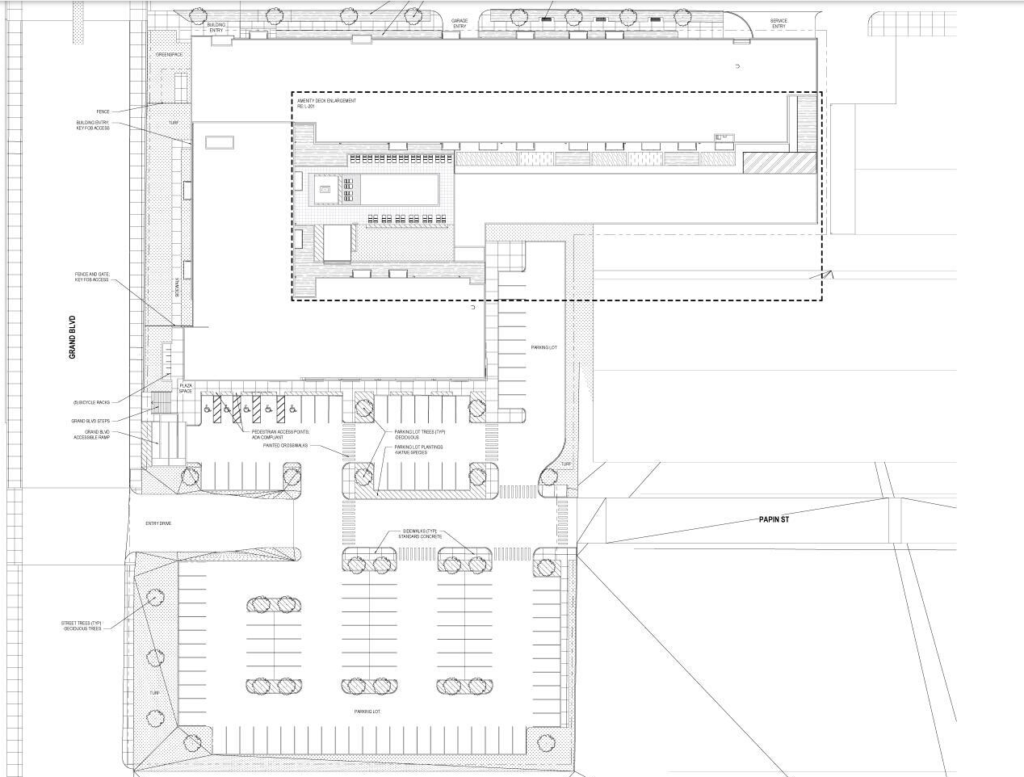

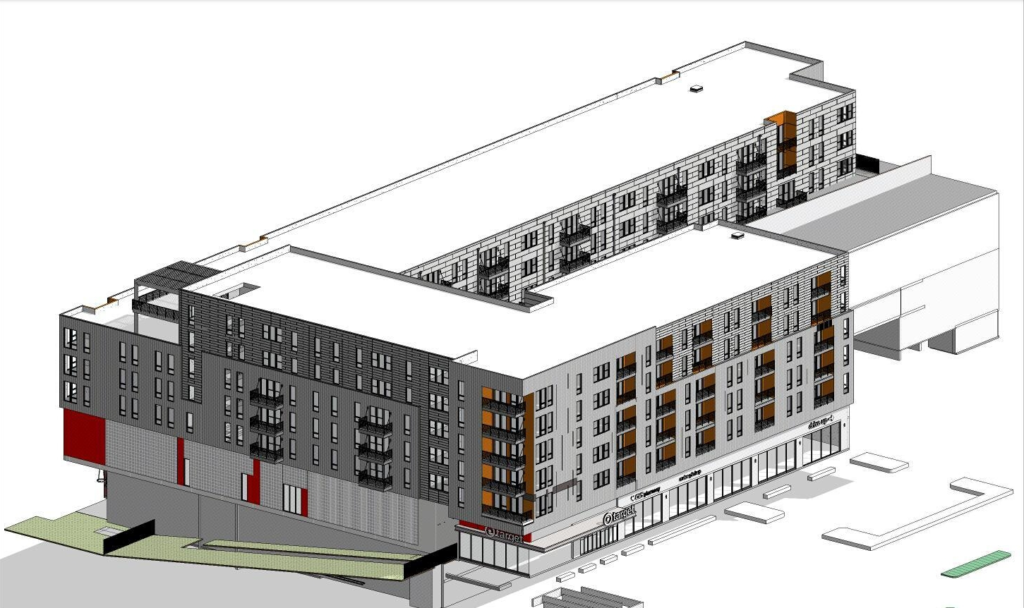

The picture is becoming clearer for the next phase of the burgeoning Steelcote Square development by Pier Property Group northeast of Grand and Chouteau in the Midtown neighborhood.

As reported last Saturday by NextSTL (h/t to Urbanitas in the urbanstl.com forum), the tenant is indeed expected to be the rumored and hoped for Target. The beans were spilled in the drawings for bidding on the SLDC Planroom website.

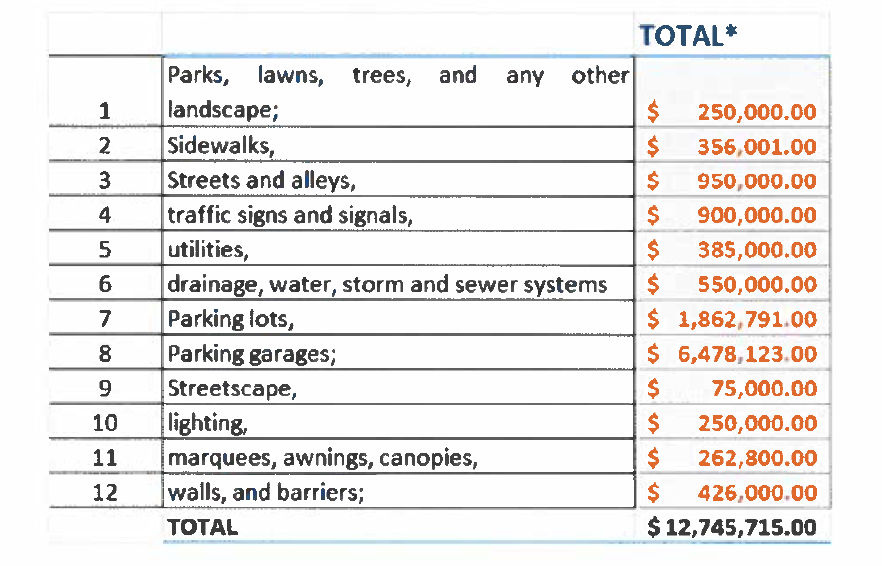

The incentive package is becoming clearer too. A CID would be created by BB110, introduced by Ald Davis, to add a 1% sales tax which will mostly go to pay for the structured parking for residents. CID board members would initially be Michael Hamburg (PPG), Michael Bailey (Fireside Financial), Kristie Bailey (Fireside Financial), Brooks Goedeker (St. Louis Midtown Redevelopment Corporation), and Zachary Wilson (Project Manager – Development Incentives City of St. Louis). Fireside Financial is an Edwardsville, IL investment group who has invested in the other three Steelcote phases as well as Expo at Forest Park.

NextSTL – Steelcote Shoppers to Subsidize Storage Spaces for Sedans and SUVs

NextSTL – Is Subsidizing Structured Parking Worth It?

Perhaps someone not financially or professionally connected to the development should be on the CID board? State Auditor Nicole Galloway took a look at Missouri’s CIDs in 2018 (Full report)-

Missouri State Auditor Nicole Galloway today released a report on Community Improvement Districts (CIDs), which found that lax oversight of taxpayer-funded projects has allowed for spending decisions to be made by those that benefit the most. Taxpayers will be burdened with increased taxes to pay for an estimated $2.2 billion in costs for more than 400 CIDs across the state. The majority of CIDs are funded by increased sales taxes.

Also they are seeking a sales tax exemption on construction materials. BB113, introduced by Ald Davis, has been introduced to sell up to $60M in industrial revenue bonds which facilitates the sales tax exemption. The value of the exemption is estimated to be $1.577M which appears on page 20 of the board bill document.

There is no definite word on a property tax abatement. The St. Louis Midtown Redevelopment Corporation, a Chapter 353 corporation, can bequeath property tax abatements without Board of Aldermen approval. There is a clue in the board bill for the sales tax exemption. On page 2 of the performance agreement which is page 127 of the PDF, it says the abatement period is anticipated to be 20 years. Nothing on the percentage. The assessed value is predicted to be $9,262,511, which would mean almost $800k in property taxes (with no abatement that is) mostly going to the SLPS.

Tax incentives could total close to $20M depending on the tax abatement. The development would be much nicer than current conditions, land productivity much higher, more people living in close proximity to transit, jobs, and amenities, a Target offering a retail option closer to a lot more people and proximate to transit. Are the incentives worth it? Would the project still happen if they were smaller? The Jones administration has been testing the “but for” question since coming into office, but in this case they are without the leverage of a board bill for a tax abatement. You have the opportunity to comment on the board bills for the CID and sales tax exemption through your alderman and at committee hearings.