Another election is coming up, and that means more tax increases on the ballot to prop up fragmentation and auto-oriented land uses in St. Louis County. The April 2016, August 2016, November 2016, April 2017, Aug 2017, April 2108, Aug 2018, and April 2019 ballots included several tax increases and bond issues. The next ballot looks much the same.

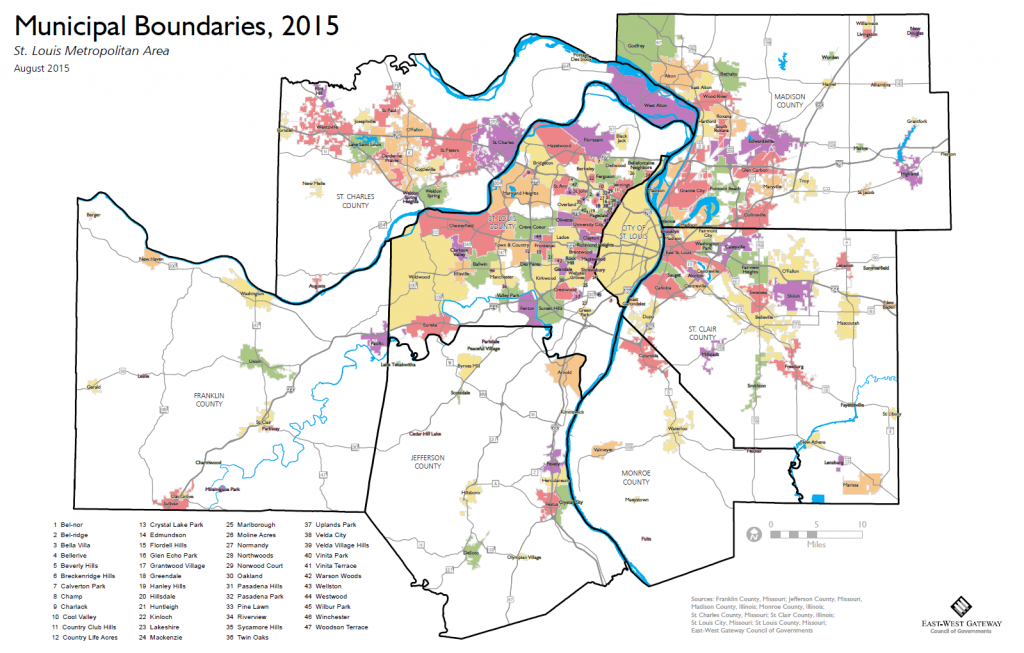

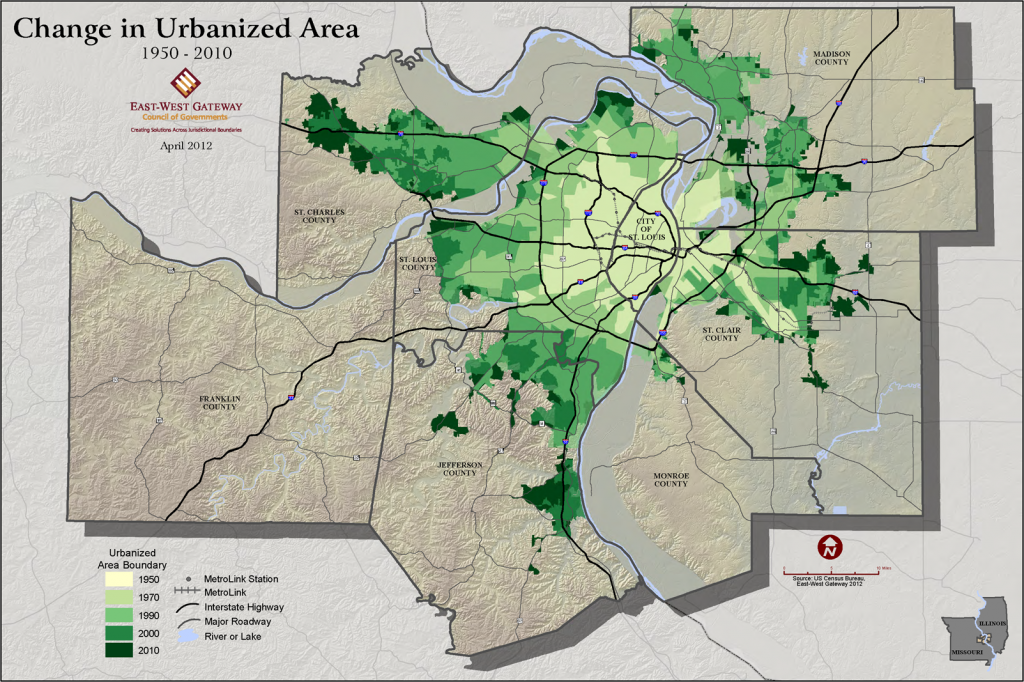

Fragmentation and low-productivity auto-oriented development patterns are synergizing in the St. Louis region, driving up the per capita cost of government services, transportation, infrastructure, and utilities. Despite $100Ms in opportunity costs and a soft tax base under our current approach, municipal leaders are thinking inside the box to keep their budgets balanced. They talk of the great efforts at collaboration, but what’s more visible is ever increasing taxes and continued tax giveaways to shift taxable sales around the county. What we need is more collaboration by default, but there are no mergers or disincorporations on the ballot.

- Bella Villa (Pop. 757)- Authorization to levy a property tax of up to $1 per $100 assessed value. Bella Villa has no municipal property tax currently.

- Crestwood (Pop. 12,404)- An additional 0.25% sales tax for fire protection

- Florissant (Pop. )- $9M of general obligation bonds for an aquatic center.

- Shrewsbury (Pop. 6,406)- Authorization to levy a property tax of up to $1 per $100 assessed value. Shrewsbury currently has a property tax of $0.377, 0.406, and 0.577 per $100 assessed on residential, commercial, and personal property respectively.

- St. Ann (Pop. 13, 019)- $12.3M of general obligation bonds for parks and an aquatic center.

- University City (Pop. 35,065)- A 0.25% sales tax for the fire department.

- Velda City (Pop. 1,188)- Increase the utilities tax to 10%

Wilbur Park has a proposition that would forgo an election if the number of candidates filed is equal to the number of positions to be filled. For example there is a race to fill two village trustee offices and only two candidates filed. In this case there wouldn’t have been an election. There would be no opportunity for a write-in candidate. Given that of the 251 races for offices among St. Louis County municipalities there are 186 (74%) that are uncontested including 6 with no candidate at all, more towns might consider doing it too. Calverton Park and Edmundson already have such a rule, accounting for an additional four uncontested races.

The propositions in Shrewsbury and University City are curious. Shrewsbury approved a $15M TIF, over St. Louis County TIF Commission objection, for the Wal-Mart-anchored Kenrick Plaza in 2013. The development has been quite successful at shifting taxable sales from elsewhere with nearly $69M in taxable sales in 2020 according to the Missouri Department of Revenue. Sales taxes accounted for 48% of Shrewsbury’s revenue in 2019 (2021 budget p. 12).

A Costco-anchored development will soon welcome visitors to University City. The expected shift in taxable sales from elsewhere and subsequent boost in revenues aren’t enough, so the city is proposing a sales tax increase. It makes sense though since the strategic goal of engagement in the TIF Wars is to tax non-resident shoppers to a greater extent.

We’ve set up a scheme resembling Enron-style accounting where debt and liabilities are hidden in subsidiaries (municipalities). Those liabilities are piling up, and we pretend they will be confined to those municipalities forever. Do we let the system unravel on its own where munis hold on until the bitter end and dump those liabilities onto the county or do we come together before the bill gets even worse?