If this kind of analysis excites you, it’s similar to what a firm called Urban3 out of Asheville, NC led by Joe Minicozzi does. We’re trying to get them to do an analysis of St. Louis. That takes considerable funding. If that’s something you’re interested in helping with please email me at richard at nextstl.com

Much of the focus of the region has been on the decline and troubles of north St. Louis County. Contrasting West Florissant to downtown Maplewood revealed why the built environment is such a liability and how it sucks away wealth rather than builds it up. Let’s look at another commercial corridor along Watson Road in Crestwood. Let’s do the math!

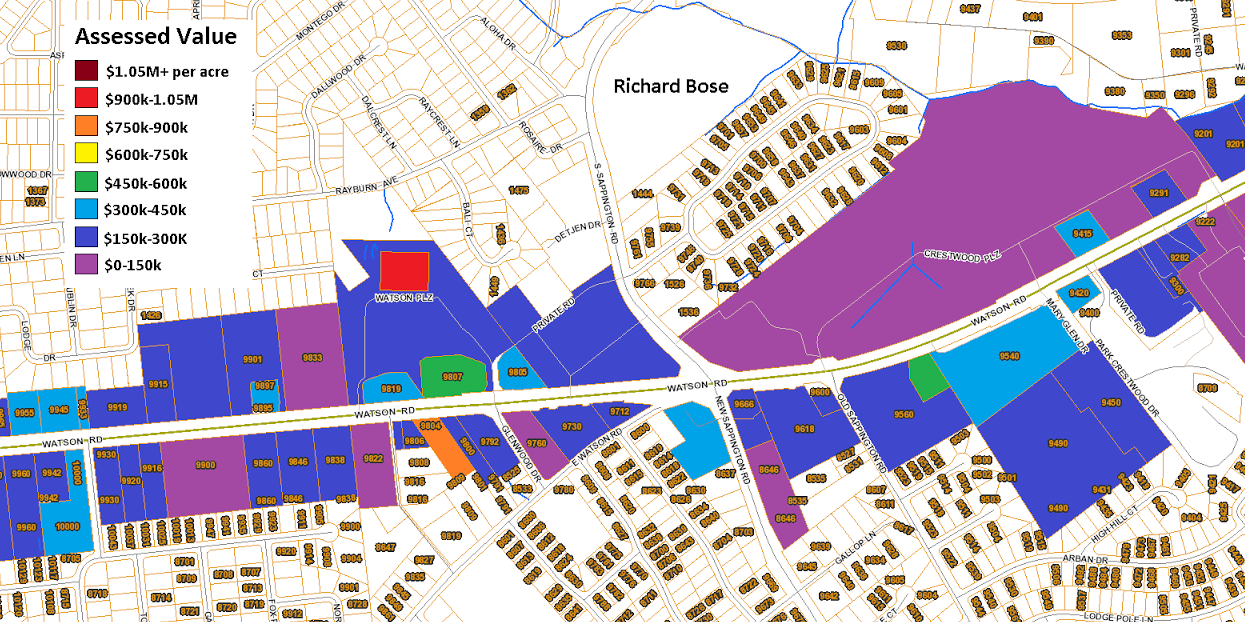

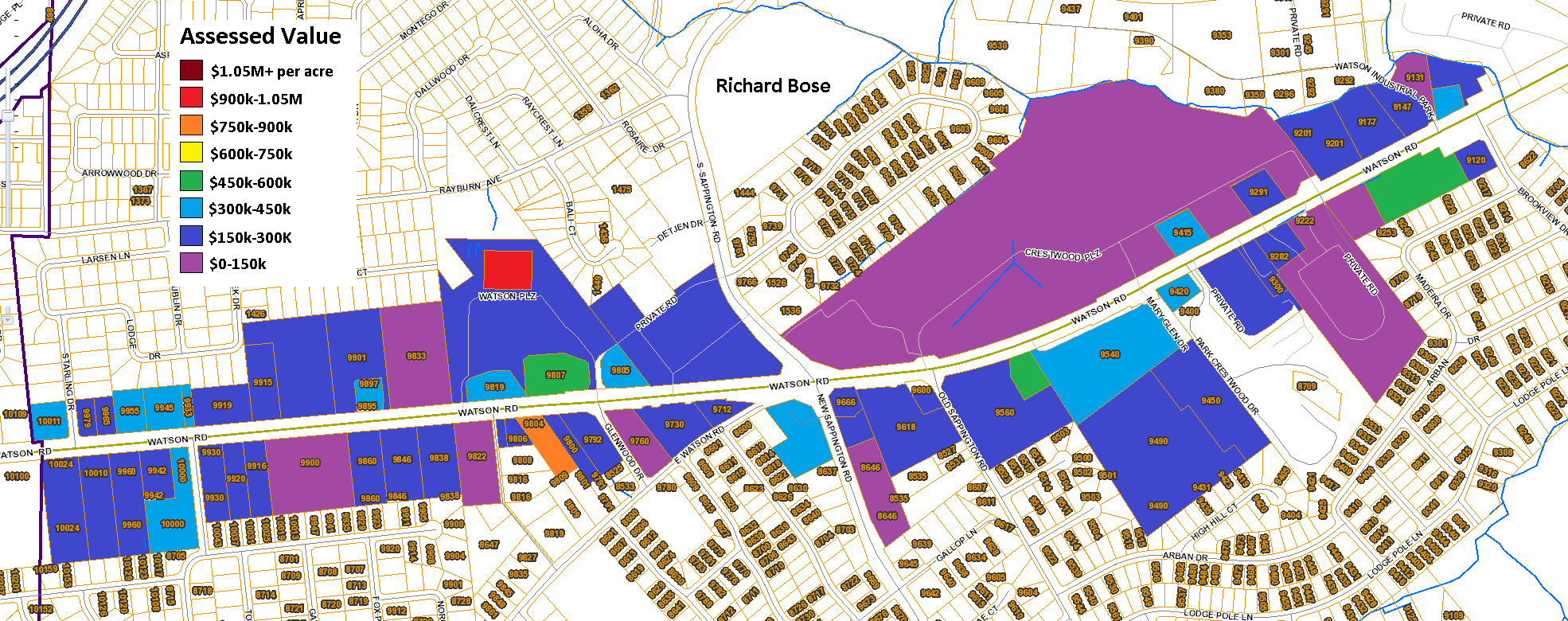

At 179 acres and $35M in assessed value the corridor’s productivity is $195,770 per acre. The commercial corridor of Crestwood occupies nearly six times the area as downtown Maplewood. Its assessed value per acre is 41% less than Maplewood’s. The most productive parcel is the Shop ‘n Save. This is because the parcel includes only the building and none of the surrounding low-yielding parking. The second most valuable is 9804 Watson which is tax-exempt and left out of the numbers above. The third is the 5/3 Bank at 9550 Watson at $567,526/acre.

With such low value it’s no wonder why cities with this type of development pattern are becoming ever more reliant on sales taxes. With such worthless structures their value must come from sales rather then the improvements to the land. As we’ve seen time and again sales tax receipts are at the whim of shopping habits tending towards the Internet, or the next new shiny shopping center on the edge, or the next TIF.

The most glaring signal of decline in the area is the shuttered Crestwood Mall. Once assessed at $28.7M in 2006 when open, it is now assessed 89% less. The quick decline of the mall exposes the vulnerability of this type of development. What happens in Maplewood when a establishment closes? People walk past it to the next place until a new establishment opens there. What happens when enough places are empty in a mall? People stop going to the trouble of driving there because one can’t tell how much of it is still occupied from the outside. Once it hits a tipping point, it crashes hard. Now an albatross, the mall sold for $3.5M at auction, and the town is left waiting for the extraordinary amount of capital it will take to bring it back to life or replace it.

Like Ferguson, Crestwood is being undermined by infrastructure and housing subsidies on the periphery of the region. Without population growth to fill in behind, Crestwood is very vulnerable. It used to benefit from being on Route 66. Now bypassed by I-44 its transportation advantage has slowly eroded as more rely on the interstate to go to a from further away homes.

Watson Road in the study area is 13.5 acres of pavement. Luckily for Crestwood it is a state-subsidized road, though not included in the Missouri 325 plan. This is a double-edged sword- the state’s priorities for the road may make it difficult to build the kind of high-productivity land uses sorely needed in Crestwood.

What stops Crestwood from becoming Ferguson? It’s housing stock is almost as old. Its median age is 13 years older. Its mall is shuttered. Its infrastructure is in disrepair. Its perception as a middle to upper middle income white area and the strength of the Lindbergh Schools keep it afloat. If either changes expect the downward spiral to begin. Or we could change land usage and infrastructure appropriations in the region to enhance places rather than undermine them.

Update 4/15/2015 – UrbanStreet’s plan for the mall site released