As the effort to bring a Major League Soccer franchise to St. Louis heats up, the Missouri Economic Research and Information Center (MERIC) has conducted a stadium economic impact study which concludes the project would result in $24.5M in net state general revenue over 33 years. This number represents the estimated impact after accounting for requested tax credits of $40M and is separate from predicted local economic impact. The full set of assumptions and revenue table are below.

Yesterday, governor-elect Eric Greitens released a statement opposing state tax credit support for the project. He was joined by comments from St. Louis County executive Steve Stenger, and St. Louis City Treasurer and mayoral candidate Tishaura Jones, opposing tax credits and other public support. As this site noted, none of those three may have an impact on determining support as the state appears set to approve $40M in tax credits before Governor Nixon leaves office, and city support is planned for an April public vote.

However, SC STL, the ownership group hoping to bring the league to St. Louis released a statement this morning saying it would reschedule today’s meeting with the Missouri Development Finance Board (MDFB) and seek to meet with Greitens to present the MERIC study. It is unclear when the MDFB meeting will be rescheduled.

This past Thursday we reported that MLS has set the team expansion fee at $150M and plans to announce teams 25 and 26 in the third quarter of 2017. St. Louis remains a clear frontrunner for a team if the stadium and financing deal can be put in place. SC STL stated last week that if the public vote were to fail, it is “highly unlikely” the effort would continue. Presumably, this is true for the requested state tax credits as well.

On nextSTL: MLS Sets Expansion Fee at $150M, Two Teams To Be Announced 3Q 2017

The Missouri Economic Research and Information Center report: The Economic Impact of a New MLS Soccer Stadium

(for reference: The Economic Impact of a New NFL Football Stadium)

Summary of Research

The Economic Impact of a New MLS Soccer Stadium

In November 2016 the St. Louis Land Clearance for Redevelopment Authority of the City of St. Louis released details for the construction of a new professional soccer stadium in downtown St. Louis. The construction of the project would start in 2017 and would be largely completed by the end of 2020. The first year of full operations would be 2020. The total project cost, excluding a Major League Soccer (MLS) expansion fee, is estimated at $205 million and includes a 20,000 seat stadium.

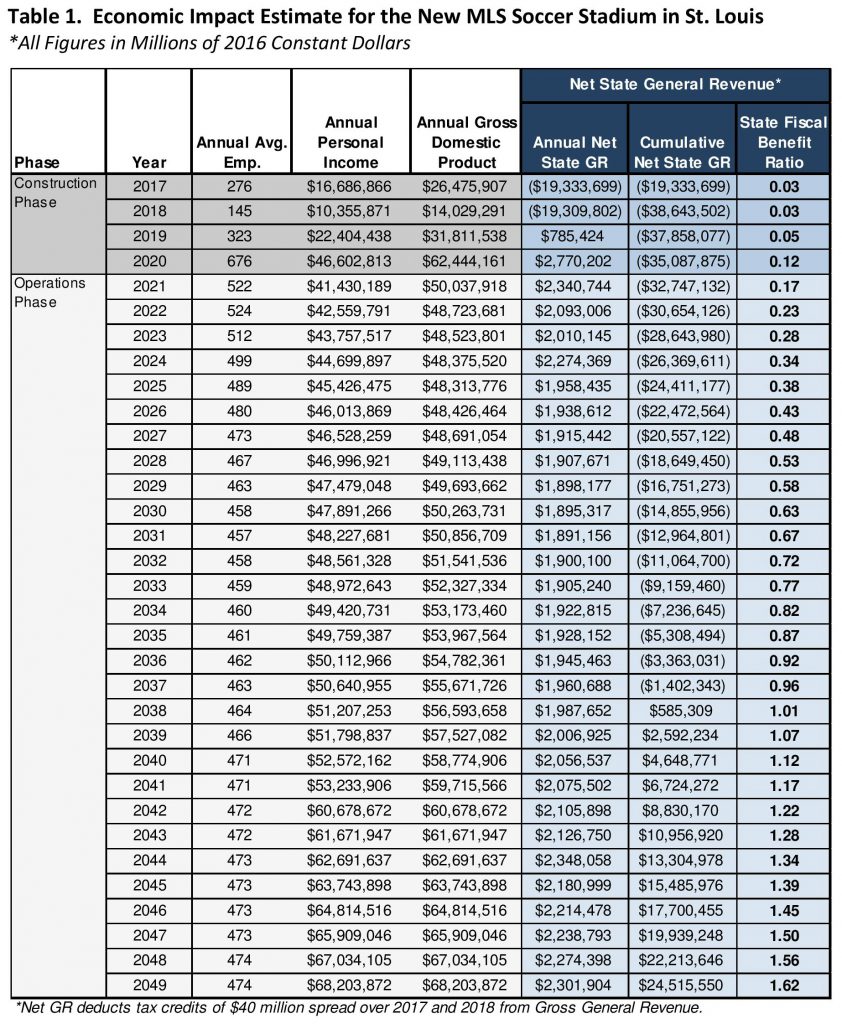

This analysis estimates the general economic impact of the new stadium construction, as well as the expected operational impacts of the franchise through the year 2049, when the original lease of the stadium is expected to end. The state fiscal benefit is calculated to consider the tax credit costs during construction and the expected tax revenues that would be generated to the state from 2017 through 2049. This research summary is based on preliminary data available from the applicant and other figures outlined in the Assumptions section. The analysis only includes the state fiscal return and does not include local fiscal benefits or costs.

The construction of a new stadium and continued operations is expected to generate $24.5 million in net state general revenue (see Table 1) over 33 years. Net general revenue deducts the $40 million in tax credits. Just over 355 jobs would be supported annually over the four-year construction period to include construction, supplier, and indirect jobs created by the spending as well as MLS activities. The franchise operation is estimated to support an average of 475 jobs annually during the remaining years. The construction and operations would contribute $1.56 billion to total state personal income and $1.74 billion to gross domestic product over the 33 years. Tax credits of $40,000,000 would result in an expected state fiscal benefit ratio of 1.62 ($64.2 M cumulative state general revenue / $39.7 M cumulative state cost in present value 2016 dollars resulting in $24.5 M in net state revenue).

Assumptions

1. Construction and operation figures derived from the application and further research of seventeen MLS team operations to determine reasonability of assumptions where applicable.

2. The construction phase begins in 2017 and is largely completed by the end of 2020. Total cost of $205 million is broken out as follows:

- Land cost of $15 million in 2017, resulting in real estate fees of $900,000.

- Stadium site work, clearance, and parking of $30 million in 2017.

- Stadium construction cost of $150 million spread over years 2018‐2021, with 95% of the spending occurring in 2018‐2020. Only 50 percent of construction costs are assumed to be paid to Missouri firms.

- Durable equipment purchases of $10 million spread over years 2020 and 2021.

3. During the construction phase it is assumed that the state sales tax intake on building materials will be minimal if a public entity tax exemption status is in effect.

4. The MLS team full‐time operations staff is estimated at 73 for Technical, Front Office and Ticketing Staff based on the average employment found on 17 MLS team websites. Payroll estimate of $5,975,000 in 2020 (first year of full team operations) was used based on the payroll data provided. Average wage growth of 2.6 percent was used for the Technical, Front Office and Ticketing Staff.

5. Player salaries were estimated at $8.3 million in 2020 with $1.2 million for designated players and $7.1 million for non‐designated players. Average wage growth of 2.6 percent was used for all player salaries and an additional 2% entertainer and athletes’ income tax was assumed to be placed on their earnings. It is estimated that 90 percent of soccer players (25 of the 28 players on the roster) will live in the St. Louis area and contribute to the Missouri economy year round.

6. The MLS stadium operations would result in an estimated $14.2 million in receipts for ticket sales based on MLS facility use research. The analysis assumes that 30 percent of event attendees would be net new to the area and 70 percent would be local consumers who would still spend income on other entertainment within Missouri if no MLS team existed.

7. Although the stadium is built at a capacity of 20,000, it is assumed that actual attendance will be less and will decrease after a few years of operation. From 2020 to 2022 attendance of 18,700 is anticipated with the new stadium per MLS event and 18,000 from year 2023 onward. Although the applicant estimates seating will increase to 26,000 by the year 2031, this analysis does not include that assumption. An average ticket price of $32.50 at the new stadium starting in 2020 is assumed with an annual growth rate of 2.8 percent.8. This analysis assumes non‐local attendees spend just over $50 per day on non‐ticket related

8. This analysis assumes non‐local attendees spend just over $50 per day on non‐ticket related purchases (dining, retail, and transportation) excluding lodging. With 20 MLS home games (including exhibition) and six other anticipated events, this results in nearly $8.9 million in average spending by non‐local attendees. The price per day estimates come from the Missouri Division of Tourism’s spending research on out‐of‐state visitors. This analysis assumes 25 percent of out‐of‐state visitors pay for lodging in the area, resulting in over $1.2 million in average spending.9. The impact analysis was developed using the REMI Policy Insight economic model (REMI)

9. The impact analysis was developed using the REMI Policy Insight economic model (REMI) and the above assumptions about future events. Therefore the results of this brief should be considered an estimate that is subject to change, based on variations in the assumptions or economy, over the time period of study. REMI has been used by the Department of Economic Development for over sixteen years to analyze the economic and fiscal impacts to the state of new firms locating to Missouri or the contribution of existing companies in threat of departure. It is a long‐term, dynamic model that considers changes in the economy over time, new fiscal costs due to migrating workers, and sales displacement when firms compete for local market share. Over one hundred and fifty organization, universities, and consulting firms use this model for impact analysis, including governmental agencies in thirty-three states. The fiscal component of the model is updated annually with Missouri Office of Administration budget figures to produce better state tax estimates.

________________________________

December 20, 2016

STATEMENT FROM PAUL EDGERLEY, CHAIRMAN, SC STL

“While we were disappointed in the statement yesterday by Governor-Elect Greitens, we respect that he and others may differ from our views. We continue to believe in the substantial economic and other benefits of this project to the State and to the City of St. Louis.

“Given current developments, we are postponing our scheduled meeting with the MDFB this morning so that we can personally meet with Gov. Elect Greitens in the days ahead to gain a complete understanding of his position and fully brief him on the project and the benefits it affords to the State of Missouri.

“As revealed in an independent study released by the Missouri Economic Research Center, the project will produce a net positive economic impact for the state with more than 400 permanent jobs created, the generation of tax revenues that more than returns the State’s investment, and the ability to build upon the continued revitalization of Downtown St. Louis. We’re hopeful that Gov. Elect Greitens, who campaigned on a pro-business platform, will welcome the opportunity to learn more about the upside of the project for the State and City alike.

“In the meantime, we appreciate the support we’ve received from Mayor Slay and we look forward to a continued transparent process with the city.”