If this kind of analysis excites you, it’s similar to what a firm called Urban3 out of Asheville, NC led by Joe Minicozzi does. We’re trying to get them to do an analysis of St. Louis. That takes considerable funding. If that’s something you’re interested in helping with please email me at richard at nextstl.com

Last time I examined a cool spot on the heat map of assessed value per acre in south St. Louis. Another cool area that stands out are the mansions on Lindell across from Forest Park. These are among the most valuable homes in the city. They are architectural gems, but are they pulling their weight? Let’s go to the land of cement ponds and movie stars. Let’s do the math!

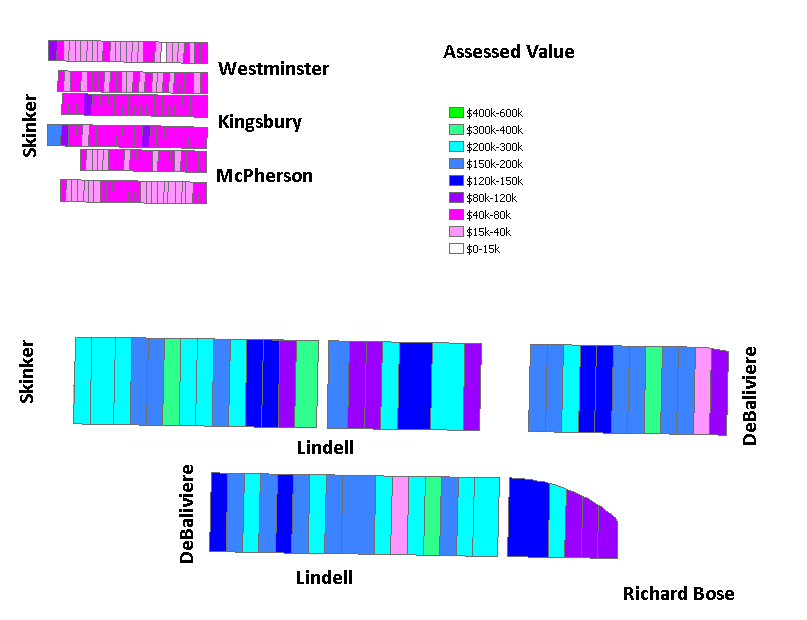

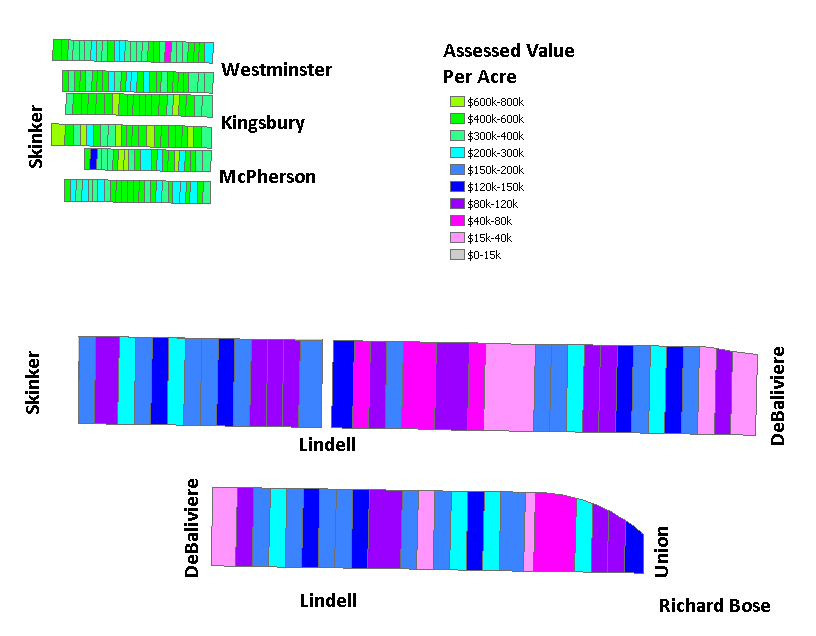

The study area covers Lindell from Union to Skinker. I left out the new house being built at 5801 and 5399W which is an empty lot that doesn’t appear to be owned by an adjacent lot owner. The area is 69 acres with an assessed value of $9,656,830 or $178,830 per parcel.

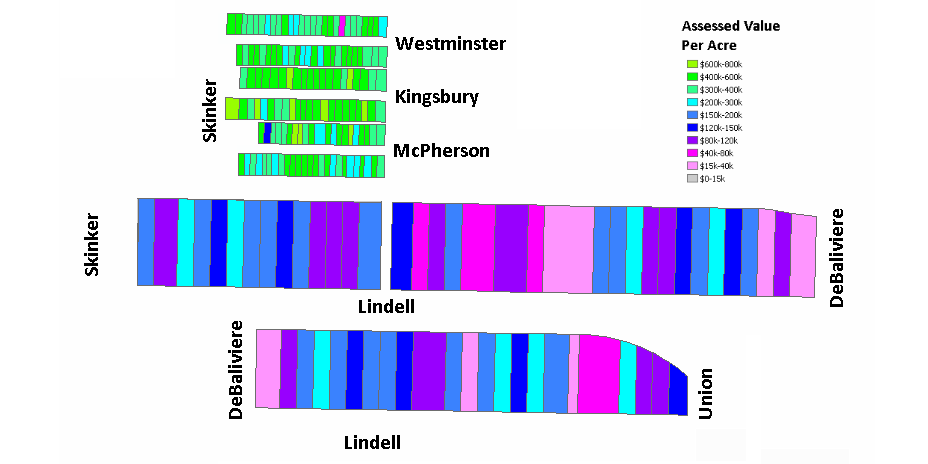

As a comparison I’ll use the fine homes of the 6100 blocks of McPherson, Kingsbury, and Westminster in the Skinker DeBaliviere neighborhood. They cover 15.54 acres with total assessed value of $6,431,630 or $46,946 per parcel.

For the question of which land use is more efficient, assessed value per parcel is akin to using miles per tank when evaluating automobile fuel efficiency. For vehicles we use miles per gallon as the important metric in comparing efficiency. For a city bound by its borders, especially so for one that can’t annex, the resource used is land. For the Lindell mansions the assessed value per acre is $139,674. For the homes on the 6100 blocks of SD, it is $413,958 per acre. That’s almost three times more than Lindell group.

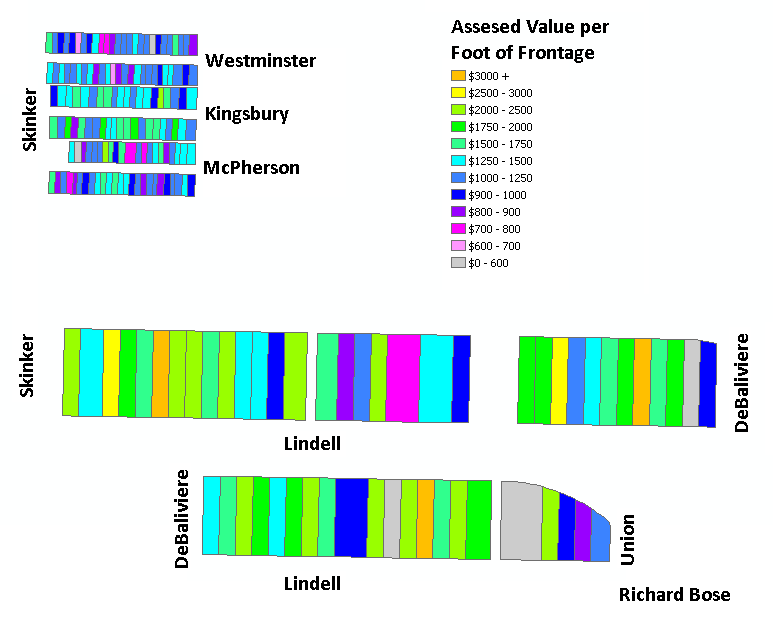

But the Lindell parcels are long. Perhaps assessed value per foot of frontage is a fairer metric. The Lindell lots come in at $1,609 per foot and the 6100 blocks come in at $1,211 per foot. The Lindell group comes out ahead. But wait, the Lindell lots don’t share the street or alley with a neighbor. Doubling the 6100 block’s number puts them 50% ahead.

No doubt on a per household basis the very valuable mansions on Lindell outshine those on the 6100 blocks of Skinker DeBaliviere, but evaluating them using different metrics reveals there’s more to consider than what meets the eye.