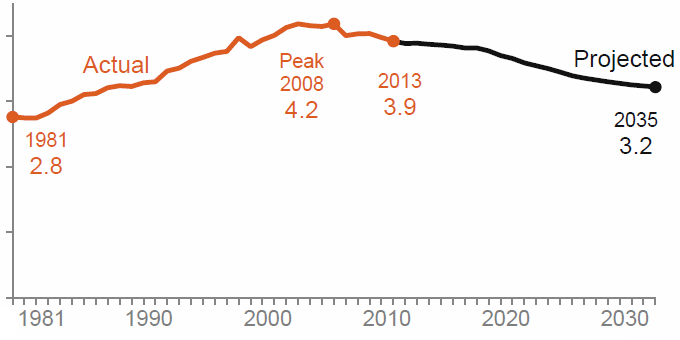

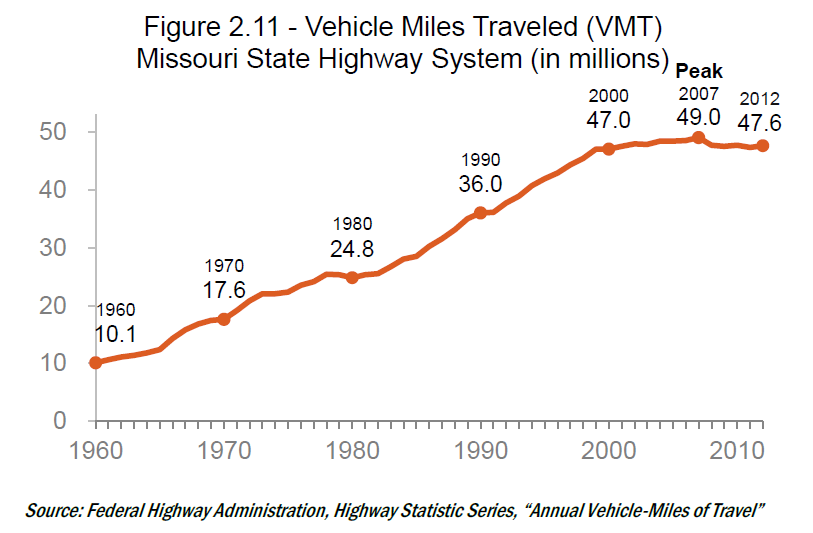

Rising fuel economy is often cited as a reason to not raise the gas tax and instead raise funds via some other mechanism to pay for our road network. Total gallons of fuel taxed has been declining in Missouri and is expected to continue dropping.

A 0.75% state-wide sales tax increase will be on the ballot this November. We will find out in a few months what will be on the project list. Most of the perceived need is in highways, the rebuilding of I-70 at a cost estimate of $2B being the premiere project.

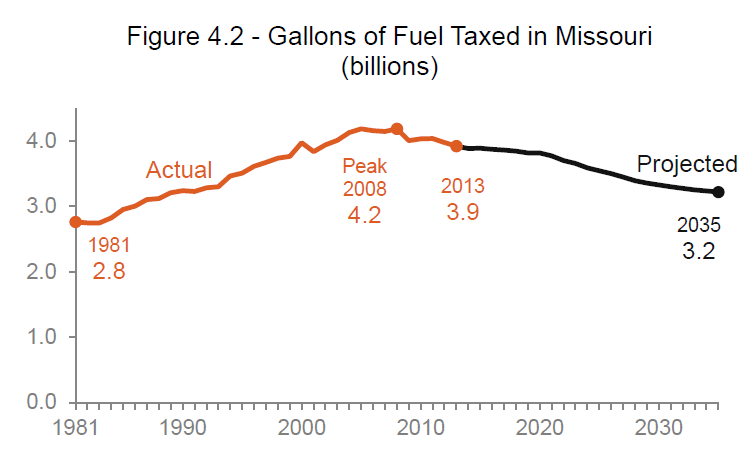

Another trend that plays into the falling number of gallons of fuel taxed is fewer vehicle miles traveled (VMT). It peaked in 2007 on Missouri state highways. This is a problem for the latest idea in raising funds for roads, a VMT Tax. Oregon is giving it a try. It has privacy and practical concerns. What if you travel a lot out-of-state? What about travelers from out-of-state? These are certainly concerns for Missouri given that its two big metro areas straddle the state line. It would offer the opportunity to charge rates depending on the type and weight of the vehicle, though probably politically tough. Also it keeps very high mileage vehicles and electric vehicles on the hook. You are charged for your road use, not on how much fuel you use. This tracks better with the damage done especially if vehicle weight were factored in.

Tolls would work well on Interstates and bridges. It would be a great way to pay for the I-70 rebuild. They can be different depending on the size of the vehicle. They would capture use as well. The consumers of a load of goods going from Denver to Indianapolis would chip in for the highway rebuild, whereas with the sales tax proposal they’d contribute nothing additional. But it would be impractical to put a toll on the majority of our roads so isn’t a comprehensive solution.

Inflation has been a much bigger contributor to declining gas tax revenues, 1996’s 17 cents is 50% more than today’s 17 cents. If it had kept up with inflation, it would have raised about 20% more over that period. In 1996 the tax was around 15% of the price of gas while today it’s about 5%. If the gas tax were a percentage of the price of gas like a sales tax rather than a set amount, it would be about 50 cents today if set to 15% like in 1996, raising even more revenue. With the volatility of gas prices the set amount is attractive though in hindsight would have done better considering how much the gas price has gone up. Illinois charges both a 19 cent gas tax (21.5 cent diesel) as well as applying its sales tax.

All of this masks the real problem. The way the funding system is set up gives a massive subsidy to heavy vehicles. Rising fuel economy has been a great thing. It’s shifting the burden of paying for our roads onto those doing the most damage to them, thus making it a more fair tax, cutting into the subsidy.

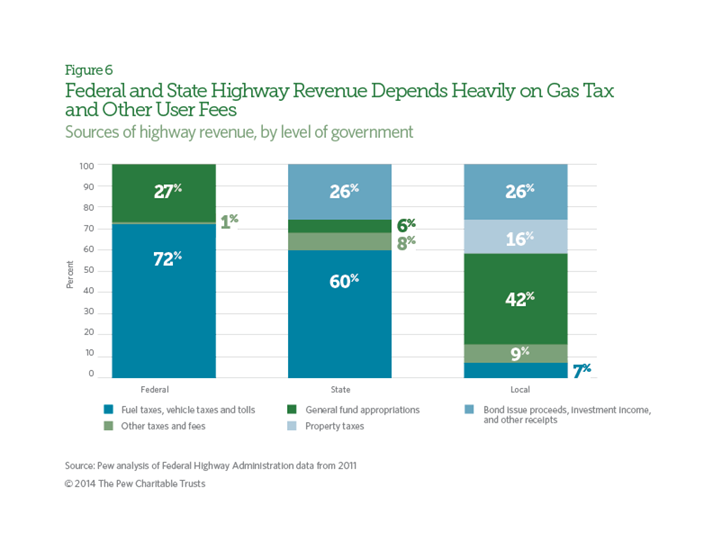

This graph from a Pew article on transportation funding reveals one aspect. Consider all the driving done on local streets and how much gets kicked up to the State and Federal governments to pay for something other than the local streets. In Missouri local governments can’t levy gas taxes.

The other big subsidy is that the gas tax doesn’t come anywhere close to taking into account the relative damage done. The weight limit for most interstates is 40 tons. A 40-ton semi does 9600 cars worth of damage. If a mid-size car weighs 3,500 lbs., or 1.75 tons, the relative fuel efficiency would need to be 420 times more for the car in order for the gas tax it generates to cover the damage it does relative to a fully-loaded semi.

Let’s compare a 40-ton semi and a car going 100 miles. Let’s assume the car gets 25 mpg and the semi gets 6.5 mpg. In Missouri the tax on gasoline and diesel is the same. The car uses 4 gallons and pays 68 cents in gas tax, while the semi uses 15.4 gallons and pays $2.62 in fuel tax. A ratio of 3.85, hardly 9600. Let’s say the car’s fuel economy increases to 40 mpg. Now it uses 2.5 gallons and pays 42.5 cents in tax. Gas tax revenues are down, but the ratio is up to 6.16, more fair. To make up for the lost revenue just raise the gas tax to 18.44 cents. Or raise just the diesel tax to 19.77 cents, this raises the ratio to 7.16.

Before you get upset about hurting good blue-collar trucking jobs, consider how much this subsidy undermines local manufacturing. So, until the average mid-sized car is getting 2,730 mpg, let’s keep raising the gas tax.