The Missouri Senate will be deciding soon on whether to enact into law SB390 (read the bill below), the “Aerotropolis Trade Incentive & Tax Credit Act”. To get a better understanding of what this bill is all about let’s go over some of the key components:

The Missouri Senate will be deciding soon on whether to enact into law SB390 (read the bill below), the “Aerotropolis Trade Incentive & Tax Credit Act”. To get a better understanding of what this bill is all about let’s go over some of the key components:

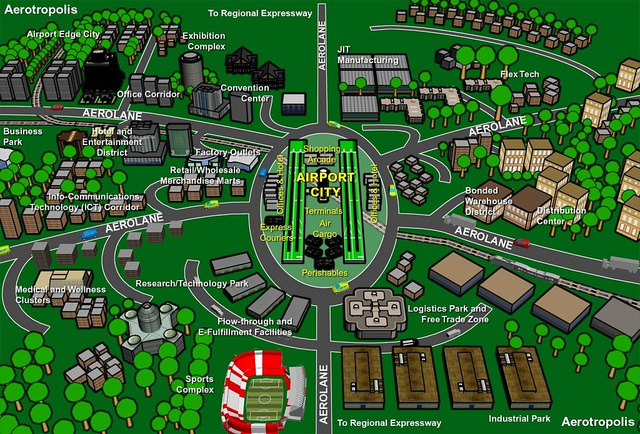

What is an Aerotropolis?

The word Aerotropolis was first coined by author Dr. John D. Kasarda. He basically describes modern airports as the core of new development, including manufacturing, distributing, hotels, retail, entertainment, residences and services. The airport will eventually transform itself into an Airport City with access through the air, rail, road and/or water, with tens of thousands working at or around the core. These effects around the core can extend as far as fifty miles from the airport.

Examples of Aerotropolis airports are Dallas-Fort Worth, Miami and Memphis in the US; Amsterdam, Frankfurt and Paris in Europe and Singapore, Kuala Lumpur and Hong Kong in Asia. Many more are developing around the nation and the world.

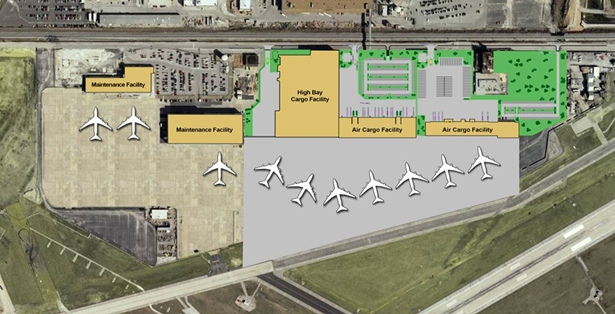

What is the initial goal of the China Cargo Hub?

Today, some 130 million of a total of 150 million pounds of freight from China is flown in and out of O’Hare Airport in Chicago with a total of 25-30 weekly flights. O’Hare is a very congested airport and frequently deals with weather issues. The Chinese like St. Louis’ central location and weather, the fact that our airport is underused and that it has plenty of capacity to grow their operations.

For Lambert to become attractive to freight forwarders (shippers) a minimum number of flights per week are required. Air freight is very costly so it is used exclusively for higher-priced and time-sensitive goods. If Lambert had only two flights a week and an airplane would break down it would be three days before the next flight would be available and that’s just too long for perishables and other time-sensitive cargo. We could simply not compete.

A 5-7 days a week flight schedule would have to be offered to raise serious interest and expanding operations to around 20 flights a week would be necessary for a long-term sustainable and profitable proposition.

What is included in the tax incentives?

The goal of the Aerotropolis bill is to give freight forwarders, manufacturers, distribution and shipping centers an incentive to move to or start operations in the St. Louis metro area to facilitate export to China on China Cargo Airlines.

It offers freight forwarders tax incentives per pound of freight exported (only outbound flights are subsidized!) as well as tax breaks on building construction loans and employee income tax. What the bill tries to accomplish is to help offset the first years of money-losing operations and thereby mitigate the initial risks.

An example: Initially there might only be enough freight to fill three airplanes per week but at least five flights per week are necessary to guarantee redundancy. The airplanes will not be fully loaded and the tax incentives will help offset the higher cost.

Interested companies would have to apply for the program and would not receive any credits until shipping bills have been verified. In other words: they have to be in business. Companies can apply until August 2019. If approved they would receive the credits based upon the volume, revenue and the number of employees as long as they are in business with a maximum of seven years.

Important to note is that the state is not just handing out money. Right now, without the hub, the state is not collecting any taxes. (Exactly $0.00) If this bill passes and economic development starts to happen, the state will start receiving taxes, less because of the incentives, but after seven years companies will start to pay normal taxes on their operations. It’s an incentive of lower and deferred taxes.

A total of $480 million is the capped amount that could be received in tax credits. If less development happens this number could be substantially lower. If no development happens it will be zero. Again, the tax credits will only materialize if private companies invest in buildings, manufacturing and jobs.

Another important factor is that, unlike TIF’s, these taxes create NEW economic development and are offered throughout the region, in fact in a 50 mile radius around the airport. For example they could benefit the old Chrysler plant in Fenton as much as North Park at the airport. Other tax programs, like TIF’s, have largely been unable to lure new businesses from outside the region but created musical chairs for companies already in the region. It was a zero-sum game.

What are the Stakes?

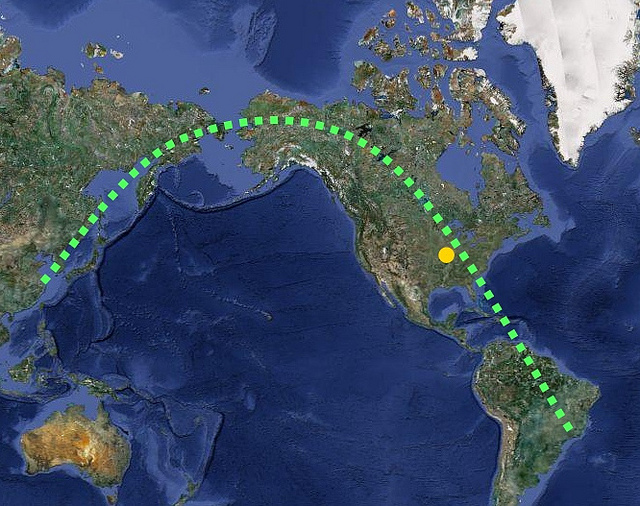

St. Louis has a great opportunity to become a gateway, not only to the East but also to the South. Asia and South America are home to the fastest growing economic powers and our region is well positioned to play an important role in the global trade between these continents.

St. Louis has a great opportunity to become a gateway, not only to the East but also to the South. Asia and South America are home to the fastest growing economic powers and our region is well positioned to play an important role in the global trade between these continents.

We can simply not afford to miss this real chance to become a player on the world stage. Other cities and regions are waiting in the wings. If we are not willing to offer tax incentives for a China cargo hub at Lambert Airport, we will lose a big opportunity and 10 years from now we will likely see another region reap the benefits of a truly global airport system. We would again be left behind.

Missouri Senate Bill No_390_Aerotropolis Trade Incentive and Tax Credit Act