The City of St. Louis will hold it’s first tax sale of the year next Tuesday, June 15th, at 9am on the 4th floor of the Civil Courts Building. There will be four sales in 2021, and subsequent sales will take place on July 13th, August 24th, and September 21. NOTE: The City’s website lists the location of the sale as outside the 11th Street entrance, as was the case in 2020 amidst the pandemic, but the on-site bulletin indicates the location as the 4th floor.

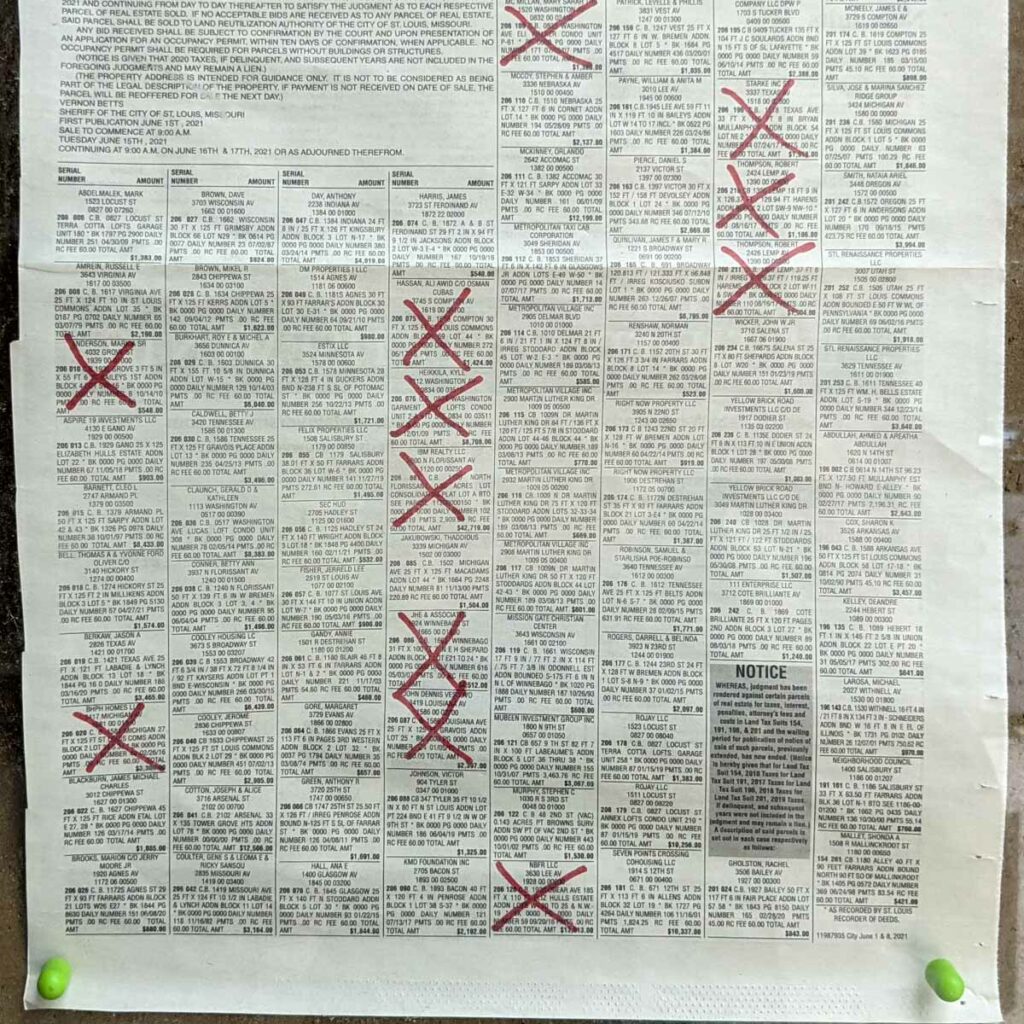

At each sale, properties are auctioned off for unpaid taxes to the highest bidder, with the opening bids dictated by the amount owed in back taxes & fees (inclusive of interest, penalties, and attorney’s fees). The clock starts ticking two weeks prior to each sale, when the Sheriff’s Office publishes in the St. Louis Daily Record the list of properties (and corresponding property owners) who are on the chopping block. If taxes are satisfied, the City updates the public in a most analog and antiquated way – by physically marking the property off of a list posted in a glass case near the 11th Street entrance of the Civil Courts Building. Interested parties – investors and individuals alike – frequent the glass case in hopes that their property of choice doesn’t receive a red “X”.

Properties that receive no bids will be sold to the Land Reutilization Authority (LRA). Instructions, fees, and additional information can be found on the City’s site.

Opening bids on the properties at this sale range from $421 to $75,957, with roughly 85% starting at less than $5,000. 3117 Locust St., located in the heart of Midtown’s Automobile Row, is the priciest of the bunch. Geo St. Louis shows unpaid taxes going back five years.

See a property owner neighbor that you recognize on the list? Let them know!

There are additional, oftentimes significant, costs associated with acquiring tax sale properties that are not represented in the bid amount. Individuals are encouraged to review property legal descriptions and consult with an attorney before bidding on any parcel of property. NextSTL makes no representations or warranties as to the accuracy, reliability, or completeness of this information.