As a member of the Missouri Senate and House of Representatives for 18 years, I was never a fan of the Tax Increment Financing law. Economically robust municipalities in St. Louis County abuse its flimsy definition of blight in order to attract redevelopment, often poaching businesses from other nearby municipalities and thickly lining the pockets of developers.

Thus, as I skeptically delved into the redevelopment project the University City TIF Commission approved last month, I was pleasantly surprised to discover that it is devised to provide both accountable and creative reinvestment in the community. It actually meets the requirement that “but for” the tax incentive the development would not take place. And, just as important, the higher revenue the development brings in will be reinvested in the area, which meets a responsible definition of blight. After learning more details I enthusiastically support the plan.

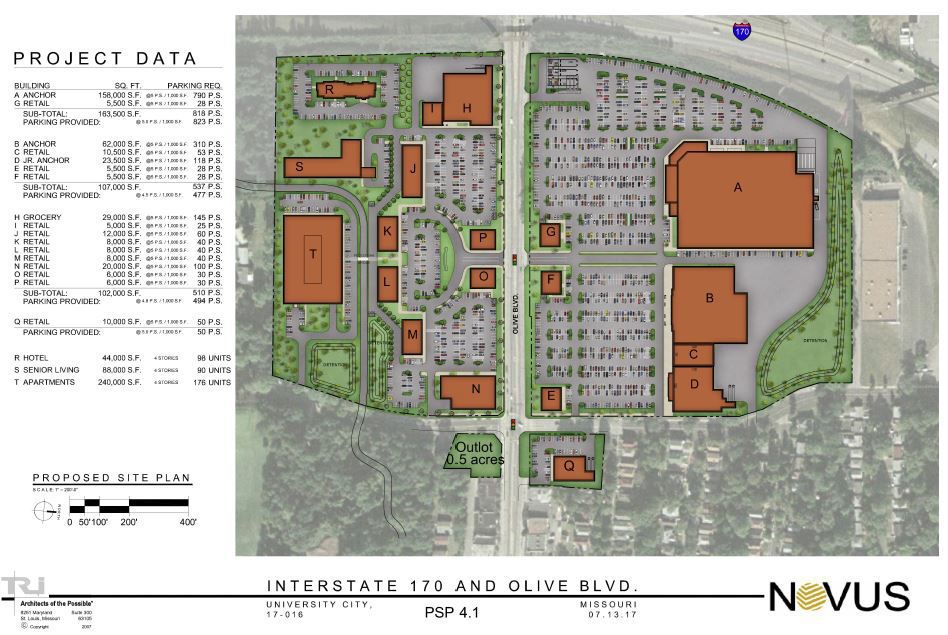

The project area comprises the northern third of University City, along both sides of the Olive Boulevard corridor east from the intersection with Interstate 170 and north and east to the city line.

For 50 years city leaders talked ad nauseam about improving Olive but did nothing. The city’s transition over the decades from a suburban bedroom community to an urban core community compels it to develop commercial potential to pay for the increasing demand of costly essential services. Revenue is flat or declining, with additional pressure from neglected and deteriorating infrastructure.

A major factor in recent years has been Washington University’s purchase of a significant number of properties in UCity. This removes them from the tax rolls but does not affect the occupants’ – workers or residents – availing themselves of city services. This transformation has shifted the burden for paying for essential services and public education from all property owners to an increasingly smaller pool of taxpayers – those who do not have non-profit tax status like WashU’s.

Decisions by the Missouri Supreme Court and the United States Supreme Court protect WashU’s property tax exemption. And the university has consistently maintained that it will not consider so-called payments in lieu of taxes, a solution that addresses this problem in other locales. Ergo, UCity (not even including the school district) foregoes more than $1 million a year income for the cost of essential services alone. It has no legal way to get WashU to pay its fair share for the services it uses.

The economic challenge has become more critical over time. Without developing new economic activity the city acknowledges it would have to propose massive tax increases. But that solution would face barriers. For one, the Hancock Amendment to the Missouri Constitution limits cities’ ability to impose new taxes or increase tax rates. And it requires that residents vote on any new tax or increase. Secondly, UCity residents would likely reject that move since city tax rates are among the region’s highest. Besides, higher taxes would disproportionately hurt the low-income residents and businesses that the redevelopment seeks to help.

The Hancock Amendment’s restrictions are a major reason cities turn to new commercial developments or redevelopment to increase revenue. They generate more tax income by generating more business that bring in more sales tax.

During a study session in February 2017, the City Council decided to boldly pursue a redevelopment plan that would encompass the businesses along Olive as well as the residential neighborhoods north. The council and staff studied several strategies that use taxes for redevelopment, analyzing the impact they’ve had on other communities, both short and long term. As a result, the city chose to create its own, unique TIF plan, which uses new taxes generated by the redevelopment’s economic activity to pay the project’s costs and provide more income for the city.

The city sent out a request for proposals to local developers. In May 2017 it chose Novus Development of Webster Groves and then, over the next year, engaged a consultant to evaluate Novus’s proposal and examine the sale of bonds, which are essential in funding a project. The city even took the unprecedented step of contracting a third party to check the consultant’s numbers and conclusions. As a result, UCity produced a distinctive revenue-generating plan that will not only meet its needs but also serve the mid-St. Louis County area of the region.

In April 2018 the city officially named Novus the preferred developer. And on August 23, the TIF Commission approved the project. The next step is for the city to reach a final agreement with Novus.

UCity’s TIF is distinguished by three project areas: commercial redevelopment on both sides of Olive from I-170 to McKnight/Woodson; the residential neighborhoods of the city’s 3rd Ward; and the entire Olive Boulevard business corridor east of McKnight/Woodson. The new money generated from the commercial redevelopment will be invested in the two other areas — the neighborhoods where families have been established for decades and the diverse small businesses along Olive.

The commercial redevelopment adjacent to I-170 causes the removal of 67 houses, 58 apartment units, 35 businesses, 2 churches and one school. The city decided early on that it would not use eminent domain to acquire homes in the commercial footprint of the project. To date, Novus has 61 homes under contract at prices that exceed the appraised value, enabling the homeowner to buy a new home and have enough money to settle in. The city is offering assistance and financial incentives to residents – both homeowners and renters — to relocate in University City.

If the few remaining homeowners refuse to sell, Novus is adjusting the site plan to accommodate them, albeit in a much-diminished neighborhood.

Novus will also purchase the commercial real estate for prices above market value. In a public-private partnership, the city and Novus will provide assistance and incentives to the businesses to stay in UCity. The city may use eminent domain for commercial properties but only after exhausting significant efforts to acquire the property through private negotiation.

Many residents of the region have expressed concern about the fate of the small businesses – particularly, favorite ethnic restaurants — in Jeffrey Plaza, at Olive and Woodson. Novus has committed to not razing Jeffrey Plaza until it has built new commercial space. The businesses will then have the option of moving into the new space, with rent subsidized until they get back on their feet.

For the remainder of the development, the city is committing the first $15 million in new revenue to reinvestment in the neighborhoods north of Olive and the commercial sector along Olive to the eastern city line. The residential area will have a $10 million fund for renovating and rehabilitating homes, assisting with buying and building homes, and stabilizing and beautifying neighborhoods with landscaping and parks. The remaining $5 million will go toward to the business district for assisting those who relocate east from the redevelopment area west of McKnight/Woodson, improving facades and making the corridor more bicycle and pedestrian friendly.

City officials have reached out from the beginning to inform residents and business owners of the broad outlines of the plan. The TIF Commission held four public hearings. And, in August alone, officials twice held meetings with 3rd Ward residents to get input on how to use the $10 million reinvestment allocation; met with business owners along Olive for advice on spending their $5 million pot; and sat down with members of the clergy to discuss the redevelopment.

One topic examined at the clergy meeting was a Community Benefits Agreement (CBA), the idea some people have advanced as a necessity for a redevelopment plan. A CBA is a pact signed by a community group and a real estate developer that outlines specific conditions, terms and amenities the developer must meet or provide to the community or neighborhood. City officials pointed out that it was already negotiating benefits, as evidenced by the $15 million in reinvestment money, and would continue by including terms for the construction companies and the development’s business occupants to employ community members and for the construction companies to meet goals for minority- and women-owned businesses’ participation. Importantly, the city has the power to hold the developer accountable for any agreement.

Another important issue the public has questioned is the TIF’s impact on the University City School District. Like other property-taxing jurisdictions in UCity, the school district will lose no property tax revenue from the outset of the project. It s taxes stand to increase from the greater economic activity generated by the TIF. Among additional benefits expected for the schools are more socioeconomically and racially inclusive neighborhoods that lead to improved school performance and the possibility of a new location for the school district’s administrative offices in the new commercial project. The school district has been included in plans for the redevelopment from the beginning, and two members of the school board occupied seats on the TIF commission and voted in favor.

Finally, after decades of stagnation and paralysis in redevelopment attempts, the people of the 3rd Ward will benefit from the reinvestment in the businesses, homes, neighborhoods, schools and other community institutions in their area of UCity. As a longtime resident of UCity I am heartened by those who live and own businesses in the 3rd Ward and have spoken out, more in favor of the project than in opposition, and their thoughtfulness, foresight and sensitivity in doing so.

The challenge facing the 3rd Ward now is to stay engaged as the city and Novus work to reach their agreement. Residents and business owners must be diligent to react, assert and give feedback as the details are developed — what their new neighborhood will look like, how the project will improve their community, and how all aspects of the redevelopment will ultimately feel and function in their lives.

Editor’s note: Opinions expressed in this piece are those of the author. Constructive and respectful feedback is encouraged in the comments section below.